ETFs in Ireland: Are They Worth the Tax Headache? A Data-Driven Look

This post doesn’t constitute financial advice and it has been written for educational and informational purposes only. It should not be taken as a direct endorsement of any specific asset type.ETFs are a popular investment choice worldwide, but in Ireland, a complex and punitive tax system makes them less attractive. This article breaks down the impact of Ireland’s 41% ETF tax, the deemed disposal rule, and how ETFs compare to other investment options helping investors decide if they’re still worth it.

Introduction: The ETF Tax Burden in Ireland

Exchange-Traded Funds (ETFs) are a favourite among investors worldwide due to their diversification, low fees, and simplicity. However, in Ireland, they come with a unique obstacle - a complex and punitive tax regime that discourages many investors.

The main issue? A 41% tax on gains, which is triggered either upon sale or automatically every eight years under the "deemed disposal" rule. Unlike Capital Gains Tax (CGT), ETF gains cannot be offset against losses to reduce tax liability. And while ETFs fall under income tax rules, no tax credits can be applied.

On top of this, investors must self-assess and report their ETF taxes, unlike managed funds, where tax calculations are handled for them. The lack of clear guidance from Revenue further exacerbates the confusion, pushing many investors to avoid ETFs altogether. This complexity may be one reason why over €150 billion remains in Irish bank deposits, earning little to no interest.

But are ETFs really not worth the hassle? To explore this, I conducted a backtest analysis to quantify the impact of taxation on ETF returns and compared ETFs with other investment options available to Irish investors. The goal is to determine whether the tax disadvantages outweigh the benefits of ETF investing.

Why Are ETFs Taxed This Way in Ireland?

Before diving into the numbers, it's worth understanding why Ireland taxes ETFs differently than other investments. The deemed disposal rule was introduced in 2001 to prevent indefinite deferral of tax liability, ensuring periodic revenue collection. However, while this makes sense from a tax policy perspective, it disrupts compounding - one of the most powerful forces in long-term investing.

ETF taxation in other countries also presents challenges, for example:

UK: Outside of ISAs, ETFs with UK reporting fund status are subject to CGT (18% for basic-rate taxpayers, 24% for higher-rate taxpayers). ETFs without reporting status face a 45% tax on gains.

Germany: Applies a preliminary lump-sum tax (Vorabpauschale) on future income from accumulating ETFs. This tax is charged annually, requiring investors to sell part of their holdings to cover it. However, brokers typically handle the tax payment, making it more manageable for a retail investor.

Costly alternatives: Eroding Cash or Riskier Bets

Many Irish investors, overwhelmed by ETF taxation, default to holding cash in the bank or investing in individual stocks or cryptocurrencies — both of which fall under CGT at 33%.

Holding Cash: Although safe, it has a hidden cost — inflation erodes purchasing power. For example, €10,000 left in cash since January 2015 would be worth just €8,130 in real terms today, a 23% loss.

Volatile Investments: Investors avoiding ETFs often turn to individual stocks, investment trusts, or cryptocurrencies. While these may offer higher returns, they come with greater risk due to lower diversification and require extensive research.

Backtest Analysis: Impact of Tax on ETF Returns

To illustrate how the ETF tax regime affects an investment portfolio, let’s consider a historical backtest scenario.

Áine’s Investment Journey

Áine, an Irish resident, invests $10,000 in an ETF tracking the MSCI World Index on 3rd February 2012. This index tracks developed markets (excluding emerging markets). For simplicity I used USD instead of EUR, mainly because the data was available in USD and to avoid currency impact.

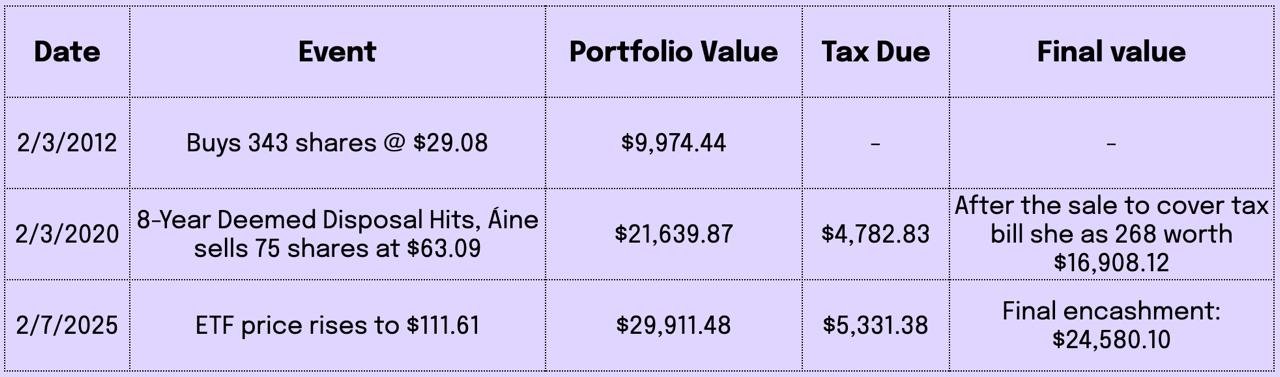

She buys 343 shares at $29.08 per share.

By 3rd February 2020 (8th anniversary), her portfolio is worth $21,639.87, and she owes $4,782.83 in tax due to deemed disposal.

She sells 75 shares to cover the tax bill and is left with 268 shares worth $16,908.12.

By 7th February 2025, the ETF price is $111.61, making her portfolio worth $29,911.48.

After offsetting the previous tax payment, she owes $5,331.38 in additional tax.

Her encashment value: $24,580.10, with a compound annual growth rate (CAGR) of 11.9%.

See the table below for a summary of Áine’s journey.

Alternative Scenarios

Let’s consider two alternative scenarios:

One option was to set aside savings to avoid selling ETFs at the 8-year mark. If Áine had saved up to pay the 8-year tax instead of selling shares, she would have ended up with $26,676.04 (CAGR of 13.6%).

There is ongoing review of Ireland’s fund tax regime, with proposals to remove deemed disposal and align tax rates to 33%. If this tax reform were implemented sooner, Áine would have cashed in $28,940.66 (CAGR of 14.2%).

See the chart below for the discussed encashment values in all three scenarios:

*DD = Deemed Disposal

Want to nerd out on this analysis? I can share my calculations with you :)

ETF vs Other Investments: How Do They Compare?

Here’s a quick comparison of some alternative investment options for Irish investors:

1. Cash & Deposits

Risk: Low

Tax: 33% Deposit Interest Retention Tax (DIRT)

Pros: Readily available, guaranteed up to €100K

Cons: Inflation erodes value, low returns

2. State Savings (e.g., An Post bonds)

Risk: Low

Tax: None

Pros: Tax-free returns, secure

Cons: Low returns, best if held to maturity

4. Individual Stocks

Risk: High

Tax: 33% CGT

Pros: Control over investments, potential for high returns

Cons: Requires research, low diversification

5. Cryptocurrencies

Risk: High

Tax: 33% CGT

Pros: Potential for massive gains

Cons: Highly volatile, unregulated, emotionally stressful

Final Thoughts: Should Irish Investors Pick ETFs?

There is no perfect investment - every option has trade-offs. Choosing the right investment comes down to your financial goals, risk appetite, and the level of investing knowledge. While ETFs in Ireland suffer from tax inefficiencies, they still provide key advantages:

Diversification: Exposure to global markets, reducing single-stock risk

Low Costs: Passive ETFs have lower fees than actively managed funds

Simplicity: Set-and-forget investing without constant research

Despite Ireland’s complex tax treatment, the right ETF strategy combined with disciplined investing can still yield solid long-term returns. If tax reform eventually aligns ETF taxation with CGT, ETFs could become even more attractive.

I would love to hear your thoughts - do you think ETFs are worth it in Ireland?